ESG at HKFoods

> Please take a look at our ESG questionnaire.

> HKFoods is a responsible investment.

> Read more about our Corporate responsibility.

EUR 20 million hybrid bond

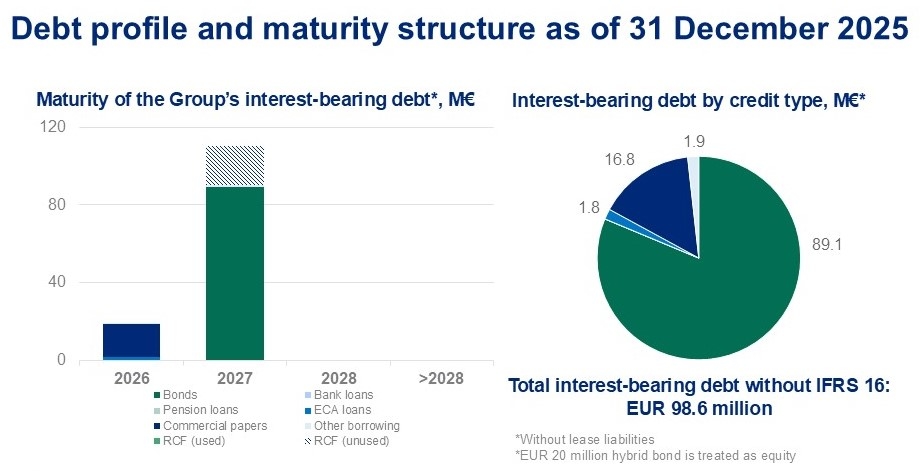

In August 2025, HKFoods issued unsecured subordinated capital securities of EUR 20 million (hybrid bond). The hybrid bond does not have a specified maturity date but HKFoods is entitled to redeem the hybrid bond at its nominal amount on the reset date of 21 August 2028 and on each interest payment date thereafter.

The hybrid bond bears a fixed interest rate of 8.750 per cent per annum starting from 21 August 2025 to the reset date 21 August 2028. From the reset date, the hybrid bond will bear a floating interest as described in the terms and conditions of the hybrid bond.

The net proceeds of the issuance will be used for general corporate purposes, particularly for refinancing the hybrid bond issued in September 2018.

Nordea Bank Abp and OP Corporate Bank plc acted as joint lead managers in the issue of the hybrid bond.

Read more: Terms and conditions of the capital securities

Read more: Stock exchange release (13 August 2025)

Bond 2027

On 17 June 2024, HKFoods issued secured senior notes of EUR 90 million. The three-year notes mature on 17 June 2027, carry a floating interest at the rate of EURIBOR 3 months plus a margin of 7.5 per cent and had an issue price of 100 per cent.

The proceeds from the issue of the notes will be used for refinancing certain existing indebtedness of HKFoods and general corporate purposes of the HKFoods' group.

Danske Bank A/S and OP Corporate Bank plc act as joint lead managers for the issue of the Notes.

Read more and access the Listing prospectus of the New Notes